Filing of complaints on

SCORES - Easy & quick

A Team that is combined with professional & practical experience in the financial industry with the best of the knowledge.

Support No : 0129-2850500

Have Some More Questions?

Get answers to all your trading and investing related queries. We are here to give you best support possible!

Frequently Asked Question (FAQ)

Section 1 (for Investors)

1. What is SCORES?

SCORES is an online platform designed to help investors to lodge their complaints, pertaining to securities market, online with SEBI against listed companies and SEBI registered intermediaries. All complaints received by SEBI against listed companies and SEBI registered intermediaries are dealt through SCORES.

2. Which are the complaints that come under the purview of SEBI?

Complaints arising out of issues that are covered under SEBI Act, Securities Contract Regulation Act, Depositories Act and rules and regulation made there under and relevant provisions of Companies Act, 2013.

3. Which are the matters that cannot be considered as complaints in SCORES?

1. Complaint not pertaining to investment in securities market

2. Anonymous Complaints (except whistleblower complaints)

3. Incomplete or un-specific complaints

4. Allegations without supporting documents

5. Suggestions or seeking guidance/explanation

6. Not satisfied with trading price of the shares of the companies

7. Non-listing of shares of private offer

8. Disputes arising out of private agreement with companies/intermediaries

9. Matter involving fake/forged documents

10. Complaints on matters not in SEBI purview

11. Complaints about any unregistered/ un-regulated activity

4. Complaints against which type of companies cannot be dealt on SCORES?

Complaints against the following companies cannot be he complaint may be against a listed entity/ SEBI registered intermediary:-

1. Complaints against the companies which are unlisted/delisted, placed on the Dissemination Board of Stock Exchange.

2. Complaints against a sick company or a company where a moratorium order is passed in winding up / insolvency proceedings. 3. Complaints against the companies where the name of company is struck off from Registrar of Companies (RoC) or a Vanishing Company as per list published by Ministry of Corporate Affairs (MCA).

3. Suspended companies, companies under liquidation, BIFR etc.

4. Complaints that are sub-judice i.e. relating to cases which are under consideration by court of law, quasi-judicial proceedings etc.

5. Complaints against companies, falling under the purview of other regulatory bodies viz. The Reserve Bank of India (RBI), The Insurance Regulatory and Development Authority of India (IRDAI), the Pension Funds Regulatory and Development Authority (PFRDA), Competition Commission of India (CCI), etc., or under the purview of other ministries viz., MCA, etc.

The relevant Regulators/Authorities for some of the grievances which are not dealt by SEBI are given below:

| Regulators/ Authorities | Grievances pertaining to | Website |

|---|---|---|

| Reserve Bank of India (RBI)/ Banking Ombudsman | 1. Banks deposits and banking 2. Fixed Deposits with Non-Banking Financial Companies (NBFCs) and other matters pertaining to NBFCs 3. Primary Dealers | https://www.rbi.org.in/ https://rbi.org.in/Scripts/bs_viewcontent.aspx?Id=159 |

| Ministry of Corporate Affairs(MCA) | 1. Deposits u/s 73 & 74 of Companies Act, 2013 2. Unlisted companies 3. Mismanagement of companies, financial performance of the company, Annual General Meeting, etc. 4. Nidhi Companies 5. Companies struck off from RoC 6. Vanishing Company. 7. All matters as delegated under overriding powers under Companies Act 2013 8. Sick companies or a company where a moratorium order is passed in winding up 9. Companies under liquidation | https://www.mca.gov.in/ |

| Insurance Regulatory | Insurance Companies | https://www.irdai.gov.in/ |

| Development Authority of India (IRDAI) | Earth, Wind, and Fire | https://irdai.gov.in/ |

| Pension Fund Regulatory and Development Authority (PFRDA) | Pension funds | https://www.pfrda.org.in |

| Competition Commission of India (CCI) | Monopoly and anti- competitive Practices | https://www.cci.gov.in |

| National Housing Bank (NHB) | Housing Finance Companies | www.nhb.org.in |

| Insolvency And Bankruptcy Board Of India | Companies where insolvency proceedings has started | https://ibbi.gov.in/en |

| Respective Stock Exchange | Complaints against suspended companies | https://www.bseindia.com https://www.nseindia.com https://www.msei.in/ |

5. Is there any time line for lodging complaint on SCORES?

From 1st August 2018, an investor may lodge a complaint on SCORES within three years from the date of cause of complaint, where;

Investor has approached the listed company or registered intermediary for redressal of the complaint and,

The concerned listed company or registered intermediary rejected the complaint or,

The complainant does not receive any communication from the listed company or intermediary concerned or

The complainant is not satisfied with the reply given to him or redressal action taken by the listed company or an intermediary.

In case investor fails to lodge a complaint within the stipulated time, he may directly take up the complaint with the entity concerned or may approach appropriate court of law.

6. Indicative instance to understand the date of cause of complaint mentioned in FAQ number 5?

If the date of declaration of dividend by a company is 01.01.2015, as per the Companies Act, 2013 the Company has to pay the dividend within 30 days from the declaration of the dividend date to all its registered shareholder. If the Company fails to pay the declared dividend within 30 days i.e. 31.01.2015 as the dividend was declared on 01.01.2015, the date of cause of complaint would be 31.01.2015 and a complaint can be lodged on SCORES within 3 years from 31.01.2015 i.e. on or before 30.01.2018.

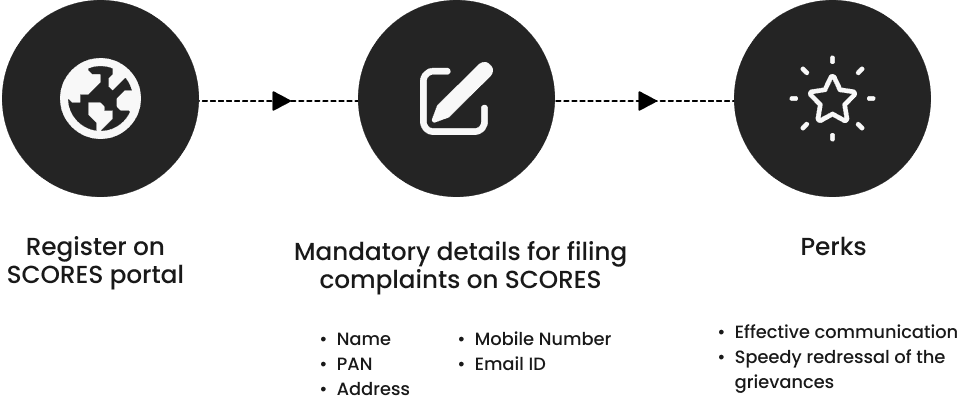

7. How can investors lodge their complaint online in SCORES?

- From 1st August 2018, it has been made mandatory to register on SCORES for lodging a complaint.

- To become a registered user of SCORES, investors may click on “Register here” under “Investor Corner” appearing on the homepage of SCORES portal. Investors will have to fill in Registration form. Fields like Name, Address, E-mail Address, PAN and Mobile Number are mandatory fields and are required to be filled up. The username and password of SCORES will be sent to the investor’s registered email id. If an investor is already a registered user, they can login by entering their username and password.

- After logging into SCORES, investors must click on “Complaint Registration” under “Investor Corner”.

- Investor should provide complaint details.

- Investors must select the correct complaint category, entity name, and nature of complaint.

- Investors must provide complaint details in brief (up to 1000 characters).

- A PDF document (up to 2MB of size for each nature of complaint) can also be attached along with the complaint as supporting document.

On successful submission of complaint, system generated unique registration number will be displayed on the screen which may be noted for future correspondence. An email acknowledging the complaint with complaint registration number will also be sent to the email id entered in the complaint registration form. A text message will also be sent to the investor informing them about registration of the complaint.

8. What mandatory information is required for lodging investor’s complaint on SCORES?

- Name

- Address

- E-mail Address

- PAN and

- Mobile Numnber

9. How can investors become a registered user?

To become a registered user of SCORES, an investor can click on “Register here” appearing on the homepage of the SCORES portal. The investor will have to fill in the registration form. Fields like Name, Address, E-mail Address, PAN and Mobile Number are mandatory fields and are required to be filled up. The username and password of SCORES will be sent to the registered email id provided in the Registration Form.

10. How are investor complaints handled?

- At the time of lodging of complaint, the investor is asked “Have you lodged a complaint with the concerned intermediary / listed company for redressal of your complaint?”

- If the investor selects the option “No”:

- The complaint will be routed directly to the concerned entity. Since this is the first time the issue will be raised with the concerned entity, such “Direct complaints” will be addressed by the concerned entity and the response will come to the investor without any interference of SEBI officials.

- The concerned entity is required to send a response to the investor directly within 30 days.

- If the concerned entity fails to send a response within 30 days to the investor, then the complaint will be routed to SEBI automatically. Thereafter, the complaint will have a new SCORES registration number.

- In case the investor is dissatisfied with the redressal of the complaint, the investor has to indicate the same against the complaint and then the complaint will come to SEBI. If the investor does not indicate the same within 15 days of receipt of reply from the company, it will be assumed that the investor is satisfied with the redressal and the complaint will be closed.

- If the investor selects the option “Yes”

- The complainant has to provide the date of taking up the complaint and also the address where the communication was last made.

- The complaint will be routed to SEBI.

11. Why are certain characters not accepted while lodging a complaint?

Certain characters are not accepted for security reasons. However, the characters which are permissible are mentioned against each field while lodging the complaint. In case certain non-usable characters are entered, then a clear explicit error message is displayed.

12. Why are some companies/intermediaries against whom an investor wants to register a complaint are not available?

It is also possible that a company/entity might have changed its name, merged into another entity or delisted or its registration with SEBI might have expired and hence its name is not available on SCORES.

13. How can investors attach a document along with their complaint?

If any supporting document is required to be attached along with the complaint, an investor can upload that document (only PDF) at the time of lodging the complaint.

There is a field “Upload Supporting Document” followed by a button “Browse”. On clicking the browse button, a pop-up window will open, prompting the investor to select the PDF document to be uploaded. After selecting the PDF file, click “Attach” button to enclose the selected document with the complaint. Please note that for security reasons, only PDF file can be attached. An investor can upload a file in PDF format up to a maximum size of 2 MB for each nature of complaint.

14. Why can investors not upload the documents in Word or Excel? What if investors do not have a PDF converter?

Word and Excel documents are editable and therefore their integrity cannot be maintained. In case an investor does not have a PDF convertor it may be downloaded readily from the internet.

15. If investors want to attach a document of more than 2MB, what should they do?

An investor can attach a document file size up to 2MB for each nature of complaint and each complaint can have up to a maximum of 5 natures. If the document size exceeds 2MB, then the document quality (dpi) may be reduced to shrink the document size to 2MB and upload only the necessary documents.

16. What can investors do if they are not able to register a complaint online?

The website of SCORES is best viewed in all the favorite browsers like, Microsoft Edge, Google Chrome and Mozilla Firefox.

Due to network issues, if at a particular time investors are not able to lodge their complaint, the investor may try again later.

17. How can investors check the status of their Complaint?

To check the complaint status, an investor can click on “View Complaint Status” under “Investor Corner” on the homepage. Alternatively, the investor can also login into their account and click on “View Complaint Status” under “Investor Corner”.

Step 1: Provide the complaint registration number which was allotted at the time of registration of complaint.

Step 2: Please enter password.

- If the investor is a SCORES registered user, then the password will be the investor’s e-mail ID registered with SEBI.

- If the investor is not a SCORES registered user, please enter the password which was communicated by SEBI in the acknowledgement letter sent to the investor.

Step 3: Enter the captcha/security code

On verifying the correctness of registration number, password and security code, the current status of the complaint is displayed.

18. How can investors know the dealing officer of their complaint?

An investor can go to the ‘View Complaint Status’ section of SCORES. Once the investor enters the registration number, password and captcha/security code, they can see the name and e-mail address of the Dealing officer handling their complaint on SCORES after keeping the cursor on the field “Dealing Office”.

19. What should investors do if they forget the password to see their complaint status?

If the investor is a SCORES registered user, then the password to see the complaint status is the registered e-mail address.

However, if the investor is not a SCORES registered user, then the password is given in the acknowledgement letter sent to them.

20. Can investors have a single password for all their complaints?

If the complainant is a SCORES registered user, they can get a single password.

21. How can investors send reminder for their complaint?

If investors want to send reminder for their earlier lodged complaint, then investors can login into SCORES using their Username and Password, click on the link “Send Reminder” under “Investor Corner”. Provide details like Registration number, Reminder details and the security code. Please note that a reminder can only be sent by the investor after 30 days have lapsed from the date of lodging of complaint. For Direct Complaints, an investor cannot send any reminder.

22. How can investors reply to a clarification sought from them?

If a clarification has been sought by SEBI or the entity against which complaint is lodged, the investor can send the reply online. The reply can be sent by clicking on the link “Send Reply” while viewing the status of complaint through “View Complaint Status Form” (Please refer to the reply to question “How do I check the status of my Complaint?”).

23. Can investors complain about market or price manipulation, accounting manipulation or violation of Insider trading regulations?

The information provided under the categories of Price/market manipulation, accounting manipulation and Insider trading will be treated as market intelligence. Therefore, no complaint number and acknowledgement shall be sent to the complainant. Also, the same would not be tracked through SCORES. This information shall be treated as confidential. This information will be analyzed and if found necessary, further action will be taken.

The status of information cannot be ascertained as SEBI conducts the investigations confidentially in a holistic manner. In order to aid SEBI to carry out its surveillance activity, investors are encouraged to provide correct and complete information. SEBI will neither confirm nor deny the existence of any investigation. Any regulatory actions taken by SEBI are published at SEBI website at www.sebi.gov.in

24. Can investors give suggestions through SCORES website?

No. SCORES has been created with the sole purpose of handling investor complaints against listed companies/ SEBI registered intermediaries. Investors can send their suggestions/queries, if any, to email id:

asksebi@sebi.gov.in

25. How long does it take the entity to respond to investor complaint?

Entities are required to submit the action taken report within a reasonable period but not later than 30 days.

26. When are investor complaints disposed of?

Complaints are disposed of by SEBI

- On receipt of satisfactory action taken report along with supporting documents, if any, from the concerned entity responsible for resolving the complaint

- On failure by the investor/complainant to give complete details/documents required for redressal of their complaint within the prescribed time

- When the concerned entity’s case is pending with court/ other judicial authority.

27. Whether investors will receive intimation about disposal of their complaint?

Yes. If the complaint is made through SCORES by a SCORES registered user, an email is sent to the complainant’s email id available in SCORES. Further if mobile number is provided by investor, an SMS is also sent to the investor intimating disposal of the complaint.

Complainants can also view the disposal details online by following the procedure given above in answer to “How do I check the status of my Complaint?”

28. What can investors do if they are not satisfied with the disposal of their complaint?

On disposal of complaint in SCORES, investors have an option to indicate whether they are satisfied with the closure of the complaint or not. If unsatisfied, the investor may tick on the ‘unsatisfied’ icon and then provide the reasons thereto. However, the investor shall have to mandatorily provide the reasons for being unsatisfied with the redressal.

This one time option shall be available to an investor for a period of fifteen days from the date of closure of their complaint in SCORES. If this option is exercised, the complaint shall be escalated to the appropriate Supervising Officer.

29. What are the difficulties in dealing with investor complaints?

In certain cases, the entity or company denies wrongdoing, and it remains unclear as to who is wrong or whether any wrongdoing occurred at all. If this happens, SEBI cannot act as a judge or an arbitrator and force the entity or company to resolve the complaint. Further, SEBI cannot act as a personal representative or attorney. But the law allows investors to take legal action on their own.

30. Can investors take legal action on their own?

Securities and other laws provide important legal rights and remedies if investors have suffered wrongdoing. Acting on their own, they can seek to resolve the complaint through the courts, consumer courts, or arbitration.

To take advantage of these laws, the complainant must take legal action promptly or they may lose the right to recover funds. It may be noted that as per the "law of limitations," there are some time periods within which court proceedings should be initiated.

31. When can SEBI take action for non-resolution of investor complaints?

For listed companies: SEBI has empowered stock exchanges to levy fine for non-redressal of investor complaints in terms of the relevant provisions of SEBI (Listing and Disclosure Requirements) Regulations, 2015 to be read with SEBI circular SEBI/HO/CFD/CMD/CIR/P/2018/77 dated 03 May, 2018.

If the complaint is not redressed/ fine is not paid, the stock exchanges can direct the depositories to freeze the entire shareholding of the promoter and promoter group in such entity as well as all other securities held in the demat account of the promoter and promoter group. If non- compliance continues, the stock exchanges may refer such cases to SEBI for enforcement actions, if any.

Notwithstanding the above, while the entity is directly responsible for redressal of investor complaints, SEBI can initiate action against recalcitrant entities including registered intermediaries and listed companies on the grounds of their failure to redress investor complaints.

32. When can investors refer their case to arbitration?

If there is any dispute (claims, complaints, differences, etc.) between a client and a member of Stock Exchange (i.e. Stock Broker, Trading Member and Clearing Member) / a member of Depository [i.e. depository participant (DP)] which has not been resolved to their satisfaction, either party can prefer for an arbitration proceedings for settlement of their disputes.

Arbitration is a quasi-judicial process for settlement of disputes. Stock Exchanges/ Depositories provide an arbitration mechanism for settlement of disputes (claims, complaints, differences, etc.) between a client and a member/depositories participant (DP) through arbitration proceedings in accordance with the provisions of SEBI Act/ Regulations/ Circulars/ guidelines read with Section 2(4) of the Arbitration and Conciliation, Act, 1996.

The limitation period for filing an arbitration reference is governed by the law of limitation, i.e., The Limitation Act, 1963.

To obtain information about how to file an arbitration claim, the following links may be seen:-

NSE:-https://www.nseindia.com/invest/about-arbitration

33. How can investors learn more on other issues related to securities market?

Investors may learn more on other issues related to securities market through FAQs provided in the link below:-

http://www.sebi.gov.in/cms/sebi_data/attachdocs/1315458767512.pdf

https://www.sebi.gov.in/sebiweb/other/

https://investor.sebi.gov.in

34. Can an investor lodge a complaint against a company which is on Dissemination Board of a stock exchange?

Companies which were exclusively listed on the erstwhile regional stock exchanges and did not get listed on the Main Board of any nation-wide stock exchange or provided exit to the investors, were transferred to Dissemination Board (DB) of nation-wide Stock Exchanges. These companies ceased to be listed companies and were transferred to DB for the purpose of providing exit to investors. Similarly companies which are compulsorily delisted by the nation-wide stock exchanges are also placed on DB for the sole purpose of providing exit to the investors.

If there is any valuation related complaint for exit from the company, then the investor may lodge it through SCORES. Since the companies on DB have ceased to be listed companies, for all other matters, the investor may approach the companies directly or the appropriate authority in this regard.

35. Is there a telephone number where investors can call to get help on matters related to SCORES?

To facilitate replies to various queries of the general public and on guiding them with regard to grievances in matters relating to securities market, SEBI launched toll free helpline service number 1800 266 7575 or 1800 22 7575 on December 30, 2011.

The toll free helpline service will answer to queries on

The toll free helpline service is available to investors from all over India

The toll free helpline service is available on all days from 9:00 a.m to 6:00 p.m (excluding declared holidays in state of Maharashtra).

Section 2 (FAQ for information of listed companies & registered intermediaries)

1. Is it necessary for all registered intermediaries and listed companies to take SCORES authentication?

Yes, except stock brokers, sub-brokers and Depository Participants

2. Why have stock brokers, sub-brokers and Depository Participants been excluded from taking SCORES authentication?

Investor complaints received against stock brokers, sub-brokers and Depository Participants are not directly routed to the respective entities in the SCORES system. The complaints are forwarded to the aforesaid intermediaries by SCORES through the platforms of Stock Exchanges and Depositories. This obviates the need of taking SCORES authentication by stock brokers, sub-brokers and Depository Participants.

However, in case of other intermediaries and listed companies, investor complaints are directly forwarded by SCORES to the entities, which necessitates obtaining of SCORES authentication by them.

3. Is it necessary for an entity to take SCORES authentication separately for each category of intermediary registration granted to them by SEBI?

Yes, an entity has to take SCORES authentication separately for each category of intermediary registration granted to them by SEBI.

4. In addition to being a SEBI registered stock broker/ sub-broker/ Depository Participant, an entity may also be registered with SEBI as some other intermediary. In such cases, is it necessary for the entity to take SCORES authentication?

An entity as a stock broker/ sub-broker/ Depository Participant has been excluded from taking SCORES authentication. However, the same entity is required to take SCORES authentication separately for each category of intermediary registration granted to them by SEBI.

5. Does the process of SCORES authentication impose any cost on the listed company or registered intermediary?

The process of SCORES authentication is absolutely free of cost.

6. Whether the listed companies and SEBI registered intermediaries which have already taken SCORES authentication are also required to send to SEBI their details as per Form-A and Form-B annexed to Circular no. CIR/OIAE/1/2014 dated December 18, 2014?

SEBI vide Circular no. CIR/OIAE/1/2014 dated December 18, 2014 has mandated that all newly listed companies and SEBI registered intermediaries are required to send their details as per Form-A and Form- B respectively in order to obtain SCORES authentication.

However, the modified Form-A and Form-B capture some additional information like PAN, date of incorporation/registration, office address, etc. Therefore, it is advisable that the listed companies and SEBI registered intermediaries which have already taken SCORES authentication may also send to SEBI their updated and additional details as per Form-A and Form-B respectively.

7. Can the listed companies / registered intermediaries who have taken SCORES authentication, update their details in SCORES?

Yes, the SCORES system enables the listed companies / registered intermediaries who have taken SCORES authentication to update on their own certain information such as address, name/details of the compliance officer, telephone numbers. Such information should be updated by the company/intermediary immediately when warranted.

However Company name, State and Primary e-mail address cannot be updated by the entities themselves. To update these fields, the entities may send an e-mail to scores@sebi.gov.in along with a revised Form-A with a request to change the same.

8. Where can the listed companies/ registered intermediaries see the Direct Complaints?

Direct Complaints are those complaints where the investor are using the SCORES platform to approach the entity for the first time with respect to their complaints. These complaints can be seen in a Tab called “Direct Complaint” on the Home Page upon logging in by the entity. All listed companies and registered intermediaries must respond to the “Direct complaints” within 30 days.

Disclaimer...

Prevent Unauthorized Transactions in your Trading / Demat account -- Update your Mobile Numbers / email IDs with your Stock Brokers / Depository Participant. Receive alerts on your Registered Mobile / email IDs for trading account transactions and all debit and other important transactions in your demat account directly from Exchange / CDSL on the same day issued in the interest of Investors.

KYC is one time exercise while dealing in securities markets - once KYC is done through a SEBI registered intermediary (broker, DP, Mutual Fund etc.), you need not to undergo the same process again when you approach another intermediary.

No need to issue cheques by investors while subscribing to IPO. Just write the bank account number and sign in the application form to authorize our bank to make payment in case of allotment. No worries for refund as the money remains in investor's account.

Stock Brokers can accept securities as margin from clients only by way of pledge in the depository system w.e.f. September 01, 2020.

Update your email id and mobile number with your stock broker / depository participant and receive OTP directly from depository on your email id and/or mobile number to create pledge.

Check your securities / MF / bonds in the consolidated account statement issued by NSDL/CDSL every month